Tax Terms plays a key role in US job market / US IT Recruitment so in-order to have good understanding about US recruitment, every recruiter must have knowledge about the US Tax Terms

Basically, US IT Recruitment works on two key factors :

- Relationship between clients and Staffing Companies

- Relationship between US IT recruiters/Bench Recruiters and the management

There are three (3) Tax Terms which are generally used in US Job market.

- W2

- C2C

- 1099

W2

W2, which stands for the wage and tax statement, is a tax form given by the Staffing companies to the Candidate in the month of January every year.

Tax : On W2 tax will be taken care by his/her employer as the employer withholds a part of pay.

What taxes need to be paid?

- Federal income Tax

- State Income Tax

- Social Security Tax (SSN) Tax

- Medicare Tax

For instance, the person who is seeking a job opportunity with a valid work authorization (US Citizen/Green card/H1B /OPT /TN visa etc.,) is termed as consultant /Candidate.

Like wise, there are some staffing agencies who take these Consultants on their bench according to the interest of the consultants.

If a H1B candidate is on one of the staffing companies (“X”) payroll (or made an agreement with an employer for a certain period) then this H1B Candidate is called as W2 of this (“X”) Staffing firm

- Only Green card /US citizen / EAD / TN Visa can work on W2 Tax Term

- H1B are not allowed to work on W2 if they are in agreement with other employer, but they are allowed to work on W2 when they are going to transfer their Visa.

- W2 Candidates will have basic benefits from the employer’s end like Medical, insurance, PTO,401K

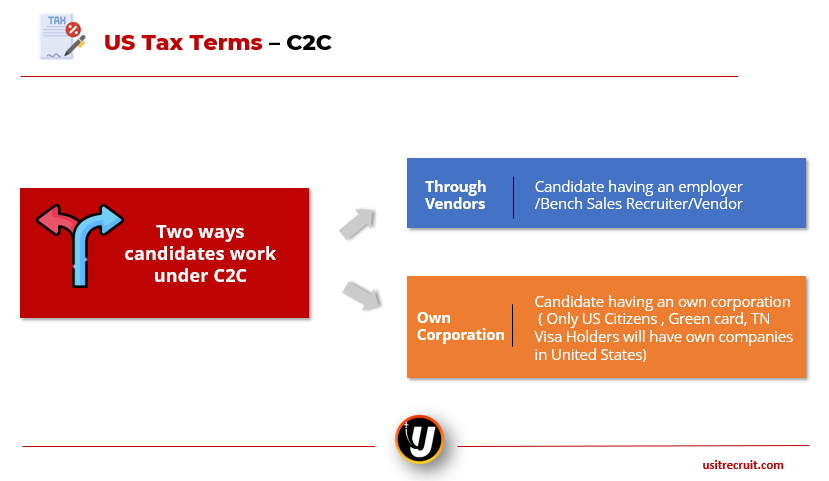

C2C

C2C is one of the commonly used Tax Terms in the US, which is the most preferable Tax by most of the consultants

C2C is an agreement between two Corporations and under this Tax Term your company/corporation is responsible for your Taxes.

Example:

- You are an employee of company – X (So you are under payroll of company -X) but you are working for company – Y, so in that case, there will be a C2C agreement between company – X & company – Y

- Company – Y is not responsible for your taxes. Only your company (Company – X) will pay all the taxes.

- Any US Valid Visa can work on C2C basis.

| Visa | Tax Terms |

| H1B | C2C |

| OPT | W2/C2C |

| Green Card | W2/C2C |

| US Citizen | W2/C2C |

| TN Visa | W2/C2C |

| H4 EAD | W2/C2C |

| GC-EAD | W2/C2C |

1099

1099 is one of the rarely used tax terms in US job market as no one prefers to work on 1099

1099 is and independent contractor or freelancer where they are liable to pay their own taxes and files their payroll.

Frequently Asked Questions on US Tax Terms

What are different US Tax Terms?

There are 3 types of tax terms i.e., W2, 1099, C2C

What is the difference between W2 and C2C or Corp-to-Corp?

C2C or Corp-to-Corp is an agreement between an individual (Valid US Visa Holder) to a corporation.

What is the 1099 Tax Term?

When a person is paid on 1099 tax terms, all the money earned by the candidate is paid on untaxed bias so, the candidate is responsible to pay the tax.

What taxes need to be paid on W2?

Federal income Tax

State Income Tax

Social Security Tax (SSN) Tax

Medicare Tax

39 thoughts on “US Tax Terms : C2C / W2 / 1099”

I need some more information regarding c2c,w2,1099,

Sure Nithin , will Rewrite the article in a more informative way.

Thank you for letting me know your issue

Can you share with me as well.

really awseome article. everey thing is define clearly with examples. thumbs up

Can you kindly help me to be on track in what basis the wages are fixed for hourly basis for these three categories fr all

can we recruit an L1 Transfer Visa holder on W2

Hello Ishfaq,

No, L1 is called intra-company transferee visa which mean L1 should only work with the company who has sponsored the Visa.

Very useful and nice article , you can visit this Corptocorp hotlist with vendor contact details on this website to make your recruitment easier and fast, every times it works

for you and your colleague suggest suggest every recruiter for this updated hotlist website,

every one can also check if you think Corp to corp

Hello arun sir, I’m a fresher in to this industry. I’m learning the the concept of this Recruitment process, types of Visas, Tax terms. Can you please give me some more details on visa and text terms that will help me to clear my interviews.

Hello Gautam,

Please refer these video links for more in-detailed explanation

Visa Types – https://youtu.be/Usmj0dqF2Kg

Tax Terms – https://youtu.be/w0ZbPUvUnf0

Boolean Search – https://youtu.be/evSK6SLHyzs

Recruitment Certifications – https://youtu.be/O2uTtTpdZTI

hello Sir , I got an opportunity to work for US staffing company and I have two options As J connect and Vbeyond. which one I need to give preference.

Very use full but some images not not visible.

Thank you Gopal , Will try to fix them

Hello Arun Sir, thank you so much for providing us a valuable knowledge.

I really appreciate your efforts for making videos on US IT Recruitment

Thank you so much Gopal!

I want to grab Us it recruiter job verbally communication skill is enough but need some knowledge about us it recruiter.

please help regarding this.. on urgent basis

Hello Vikrant, Thank you for writing your concern here , Communication and knowledge on US IT Recruitment process plays a integral part

Thanks for the information. Clearly explained. appreciate you bro.

Thanks! Rizwan

its was a really great information thank you

Thanks! a lot Abhi

Hello Arun,

I have handled US recruitment 12 years before and took long break in my career. Recently I joined back and I almost got blanked with these terms. Your article really helped me to get it on track. Can you kindly help me to be on track in what basis the wages are fixed for hourly basis for these three categories pl

Very useful article. Everything is clear and defined with good examples.

Thanks! And glad that you loved the article

You can also visit https://www.youtube.com/c/usitrecruit for more videos on US IT Recruitment

It is really helpful for beginners like me.

Update me if anyone have suggest for me

It is an amazing article & helpful for beginners like me.

Update me if anyone have suggest for me

Thanks, Karan!

We are glad that are loving our articles and will be coming up new articles and tools

Very Useful For Fresher’s

Thank you Shaikh!

Thanks for sharing a detailed information abot C2C, W2 and 1099. It is very usefull for begineers of US IT Recruiters.

Hello

Thanks for sharing a detailed information about C2C, W2 and 1099.

Great explanation

Thank you Swathi!

Hello Arun,

ur article is very simple I mean easy to understand and well knowledge-based. If any one wants to starts their caree as a US IT Recruiter this is enough.

Thank you so much Yamini

That’s very very simple and informative and explained very well. It took me few minutes to understand all three terms.

Good one and very easy to grab for the new ones…!

Stay blessed and keep sharing your knowledge like this…

Thank you so much for your support